ZT20 #008: Crossing the Efficient Growth Chasm

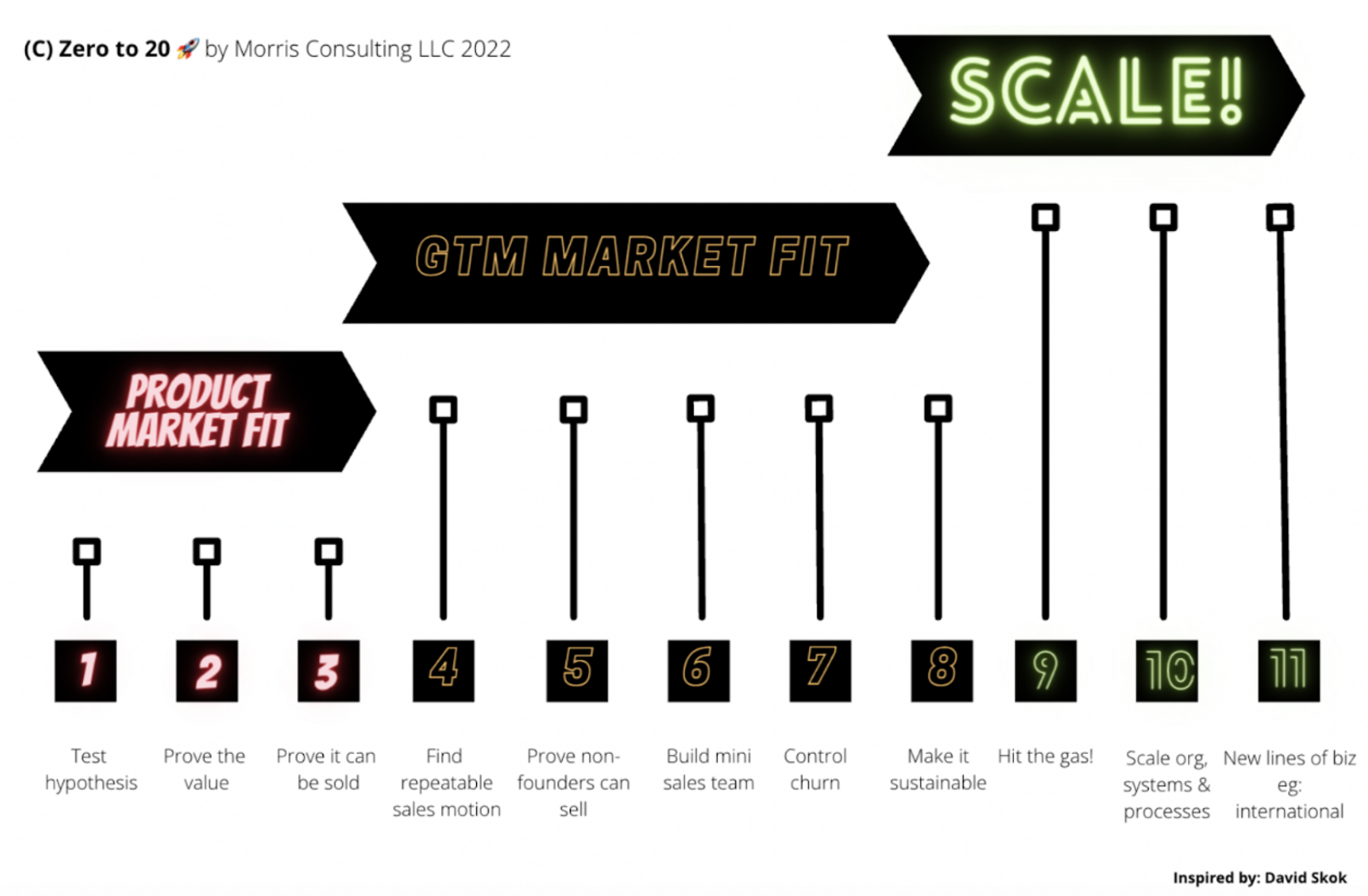

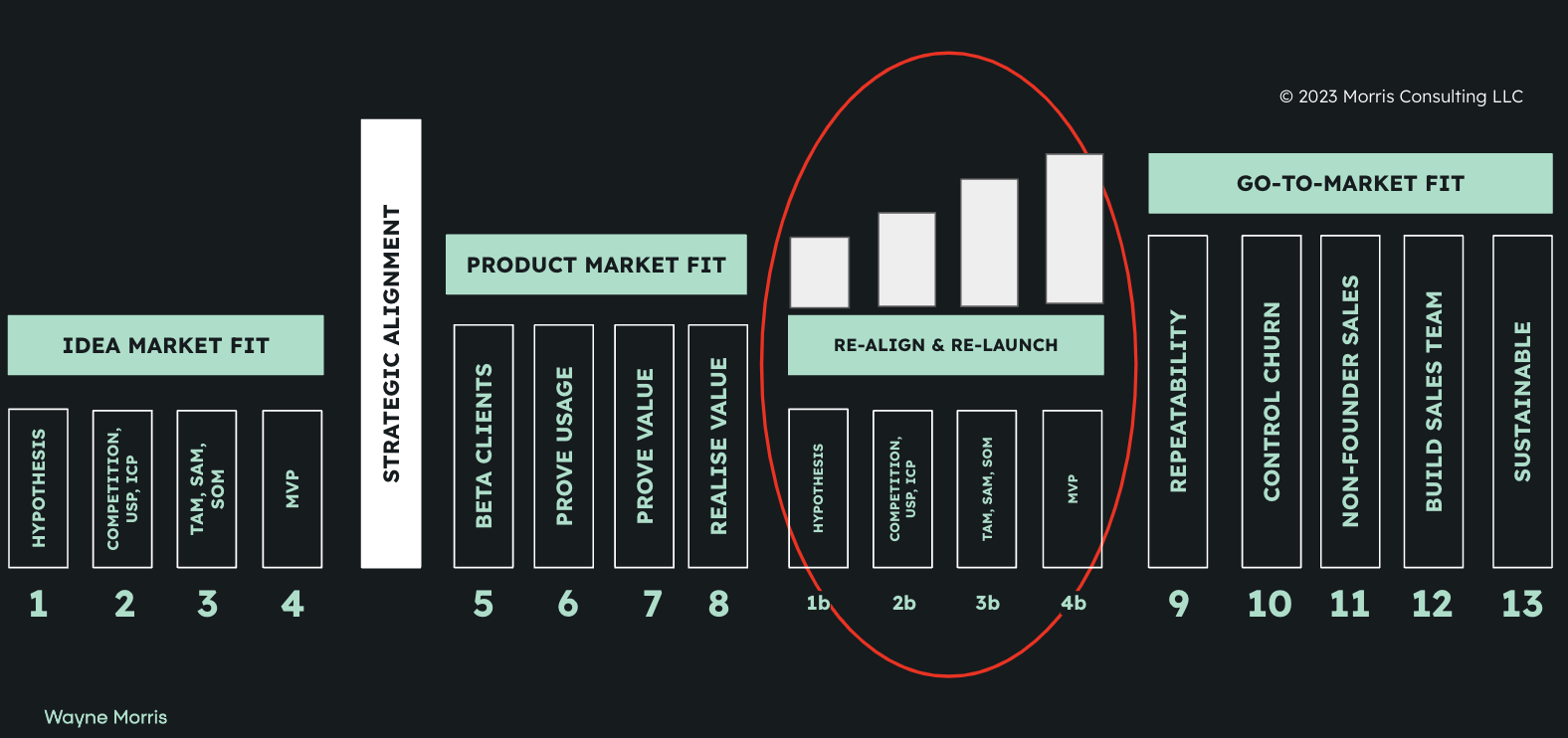

Jul 11, 2023In my original “Phases of Startup Growth” continuum which I developed to accurately assess and pay down go-to-market debt, the first phase was a 3 pillar phase called “Product Market Fit” (PMF). That’s because PMF is universally accepted to be the first major milestone any tech founder has to achieve in order to illustrate they have a business that can be empirically assessed as being venture-backable.

Fig 1: The v1 of my continuum.

However, when I looked back at the companies I helped build from $0 to $20M in ARR and then compared those experiences with my portfolio of early-stage B2B SaaS clients today, I realised that much of my success in working with founders was in successfully having them use the data gathered in the PMF stage to re-align and re-assess many of their early-stage assumptions. This temporary reflection was critical in giving them the best chance of successfully crossing the chasm between product market fit and “go-to-market fit” (GTM fit).

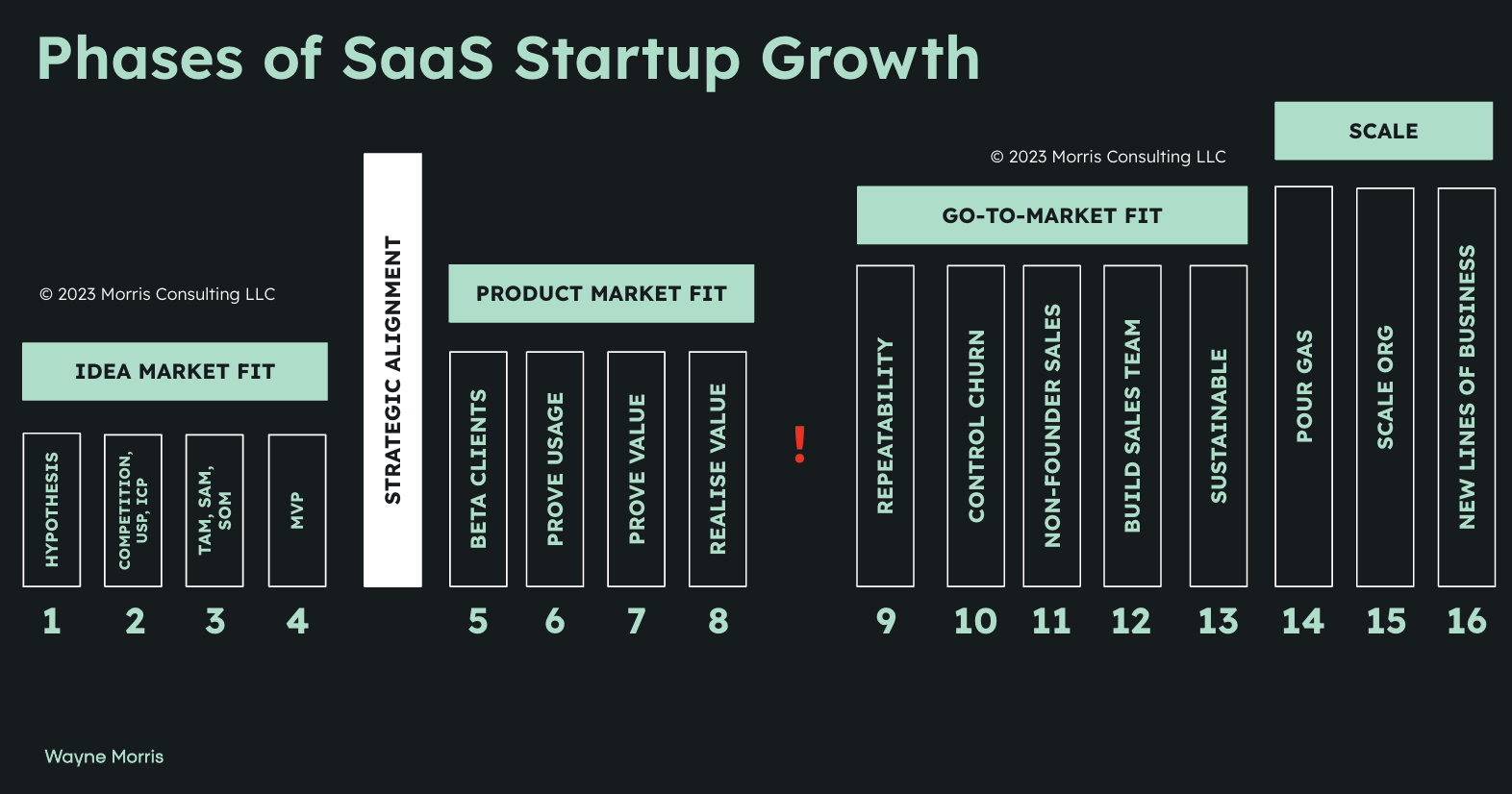

In my 25 years in early-stage B2B SaaS, the founders who are open to frequently double-checking their startup is aligned around the optimal opportunity have proven to have the greatest chance of success. And that’s why I recently formalised the “idea market fit phase” as the first phase in my continuum, moving PMF to phase 2.

Fig 2: H1 2023 iteration

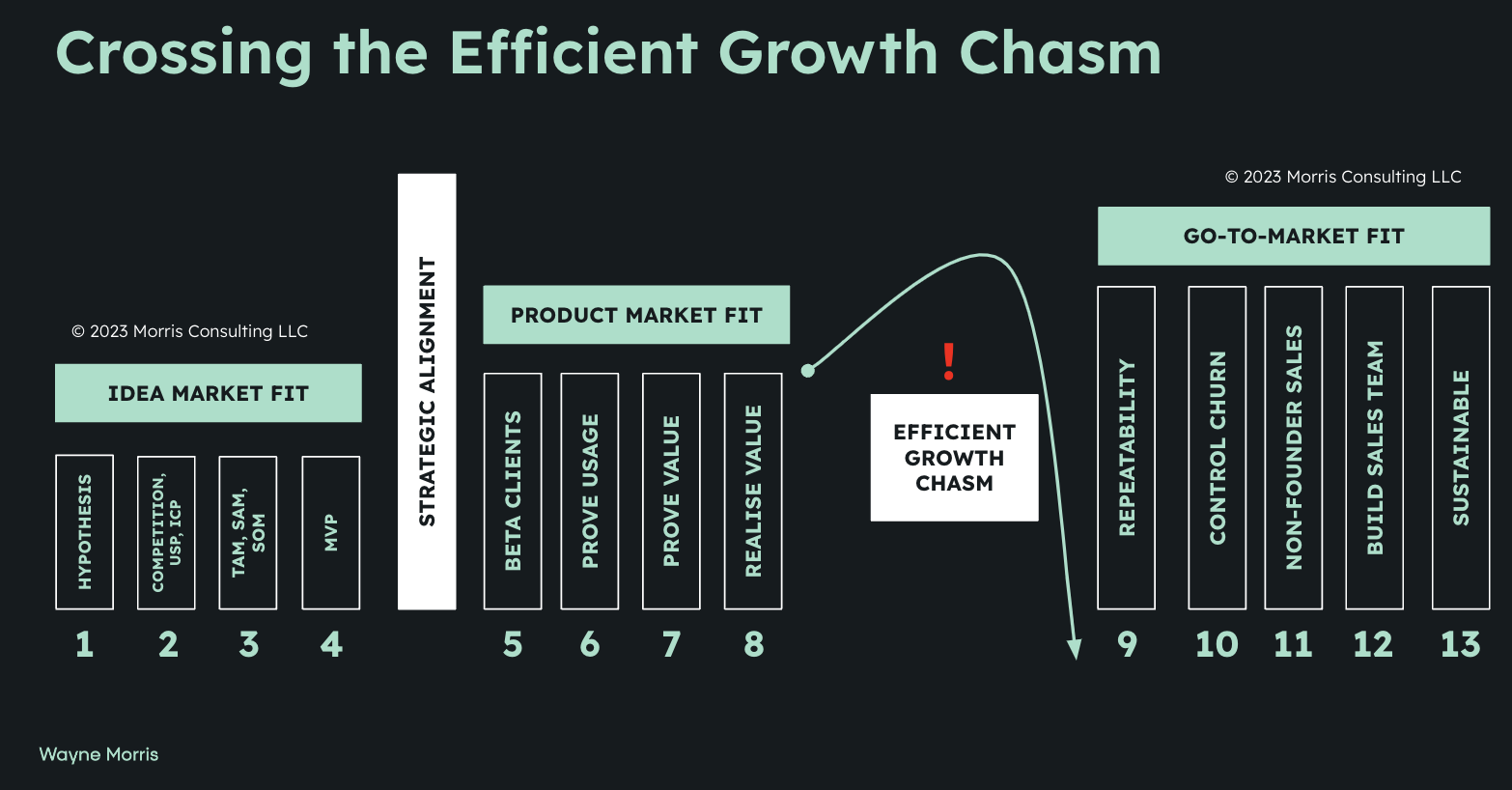

In temporarily but decisively moving ‘backwards’ down my continuum post the PMF fit phase, my startups were able to successfully cross what I call the “efficient growth chasm” which spans the product market fit phase into the GTM fit phase of growth. The result was the famed “hockey stick” growth curve.

Fig 3: Zooming in to highlight the “efficient growth chasm”

Going backwards is rarely if ever spoken about in SaaS. Eric Ries covers it somewhat in his book “The Lean Startup” when he covers the ‘pivot or persevere’ question. However, whilst the pivot and persevere question is important to assess, what I’m talking about here is less ‘pivot or persevere’ and more ‘realign and relaunch’.

I don’t see this strategy spoken about often if ever, but in 25 years of doing this, and now doing this at scale with multiple startups at once it’s a critical factor in crossing the chasm between product market fit and go-to-market fit, and more importantly, doing so both efficiently delivering predictable pipeline and fast growth as a result.

In today’s market, where efficient growth is front and centre for every B2B SaaS founder, this approach gives founders the best chance of simultaneously minimising dilution and maximising growth of their startup.

The critical foundational phase of every startup

Idea market fit (IMF) is the critical foundational phase for any startup, it’s where founders move from hypothesis, through market analysis, into the development of a minimal viable product and end up with their team being strategically aligned around the opportunity and target audience.

It’s the foundational phase that positions the startup to make its preliminary assault on the market.

However, the mistake I see most founders make is that under pressure from their investors and founder peer group, they more often than not see it as a “one-and-done” phase of their evolution. The idea of going backwards is perceived as slowing down, falling behind and falling out of favour with their VCs who are in this for “venture level growth”.

In my experience, failing to go back to idea market fit once you have achieved product market fit, will result in a potentially significant accumulation of go-to-market debt and a lack of focus that will stymie a founder’s ability to optimally scale revenue, and in turn, it will challenge their ability to have the breakout success they and their investors are in this for.

Learning Phase

The product market fit stage is not primarily a revenue stage, another mistake founders and unwittingly hired VPs of Sales hire at this stage make. Sure there will be some revenue, but the real value is in the intelligence gathering - every decent VC knows this. Here are some examples of the deep learnings you’ll see at this stage of growth:

- Messaging: discover elements of your value prop that resonated most with the market.

- Sales process: high-velocity iteration of the sales process to win your first customers

- Onboarding: high fidelity insights into what it takes to successfully onboard and delight new customers

- Usage: active user stats by feature, to validate key product-related aspects of product market fit

- Relationship management: understanding how to optimise multi-threaded client relations to ensure value creation is optimal

- Value exchange measurement: understanding the actual value created by your product

- Value exchange realisation: realising the fair value of your product in hard $ and hard contracts.

- Longer-term contracts: understanding what it takes to sign longer-term contracts

- Iterating ICP: using the information gathered in this phase to iterate the original hypothesis

It’s this final point that is key, iteration of ICP.

The learning in this phase is rich and valuable but revenue will be unpredictable. The unpredictability of revenue is one of the reasons why VPs of Sales entering the startup at this phase should hard negotiate non-recoverable draws, ie: 100% of OTE guaranteed for 3-6 months. In reality though, in my opinion, VPs of Sales should not be hired at this stage, it’s premature.

It’s on the founding team to own this stage of growth. My golden rule if you’re thinking of hiring a VP of Sales at the PMF stage of growth is this:

“if you don’t have product-market fit, and you’re hiring a VP of Sales to fix that, change their title to co-founder and give them the equity they deserve.”

However, what’s not unpredictable at this stage is the learnings, they will be rich and super-valuable, if this stage of growth is executed optimally.

Example outcome of PMF phase

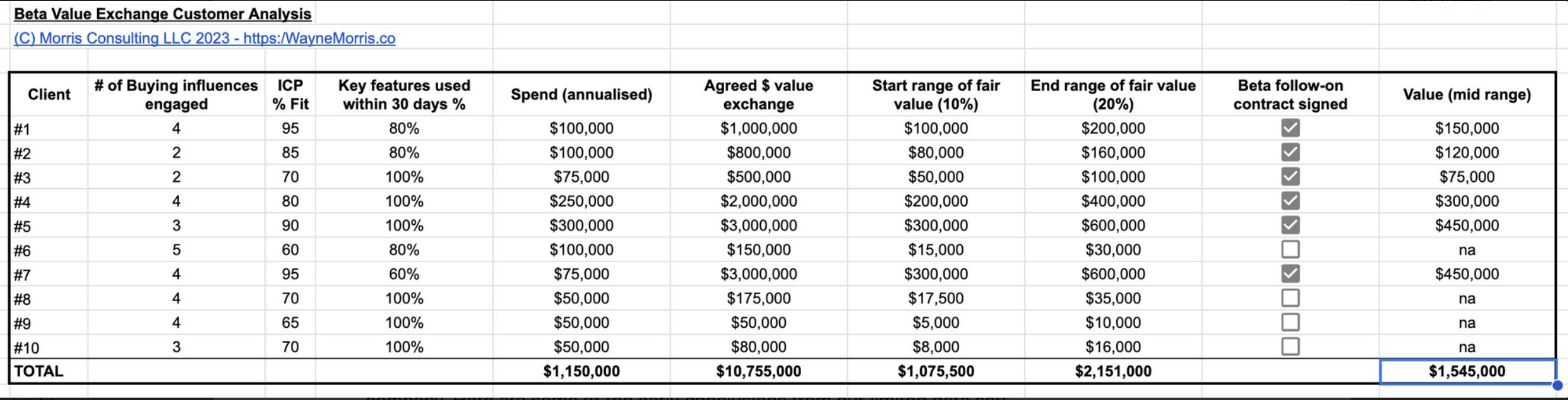

In enterprise B2B SaaS ($50k+ ARR contracts), we are looking for around 10 clients for a beta program. In my experience, this is typically enough signal to make significant future capital deployment decisions.

We’re fundamentally looking to establish the value we created within the beta client base. Whilst this is far from a trivial exercise, when expectations are set clearly and firmly, beta clients will be forthcoming in working with founders to establish the value exchange (more on beta programs and establishing value exchange in a future article).

Here is what the data set from a typical enterprise B2B SaaS beta program may look like:

Fig 4: Example data set from an initial beta set of enterprise SaaS customers

Across this data set of 10 clients, all of whom meet the pre-determined threshold of achieving 60% of the key ICP criteria, there are some critical learnings that will shape the future of the company. Here are some of the early conclusions from our limited data set:

- Regardless of active feature usage, if the client doesn’t meet at least the 70% ICP threshold, the value exchange will likely not meet our minimum threshold, we need to increase that threshold

- However the reverse is true if the ICP percentage is high, lower feature usage may not impact value exchange.

- Only 6/10 beta clients have an end-range fair value of >$50k, meaning the GTM unit economics in 40% of this beta cohort don’t make sense for this startup today.

- However, the mid-range fair value of the 6 clients ($1,545,000) is 34% higher than the total annualised spend of the original contracts from all 10 beta clients.

- We need to tighten our ICP further by focusing on the characteristics of both the firm and the buyer personas that reflect the highest value exchange.

- We need to adjust pricing according to the fair value observed in the beta cohort.

(Disclaimer: I recognise there are a ton of hypotheses not covered here that warrant deep exploration and discussion, the above are a selection of examples based on this data set)

Crossing the efficient growth chasm

In my experience, most founders will not operate this kind of GTM growth program, or pretend they are with flawed or made-up data as optics to get VCs or execs on board, but they will definitely pay for it in the future.

However, even those that build in such a structured fashion also often succumb under pressure from VCs and their peer group and either ignore or fail to apply the deep learnings from the PMF stage, and continue without refining their GTM processes.

The end result (using the data above) is that 40% of their efforts will go towards acquiring and managing clients that will stymie their ability to drive venture growth, and they will dilute themselves unnecessarily as they raise capital to maintain this GTM debt in their business - it’s hubris at its finest!

As a result, most will fall down the efficient growth chasm.

Instead, what they should do is use the learnings from the PMF stage to iterate the learnings in the IMF stage to re-align and re-launch their strategy into the GTM fit phase of growth.

Fig 5: Highlighting the nuance of how to cross the “efficient growth chasm”

Summary:

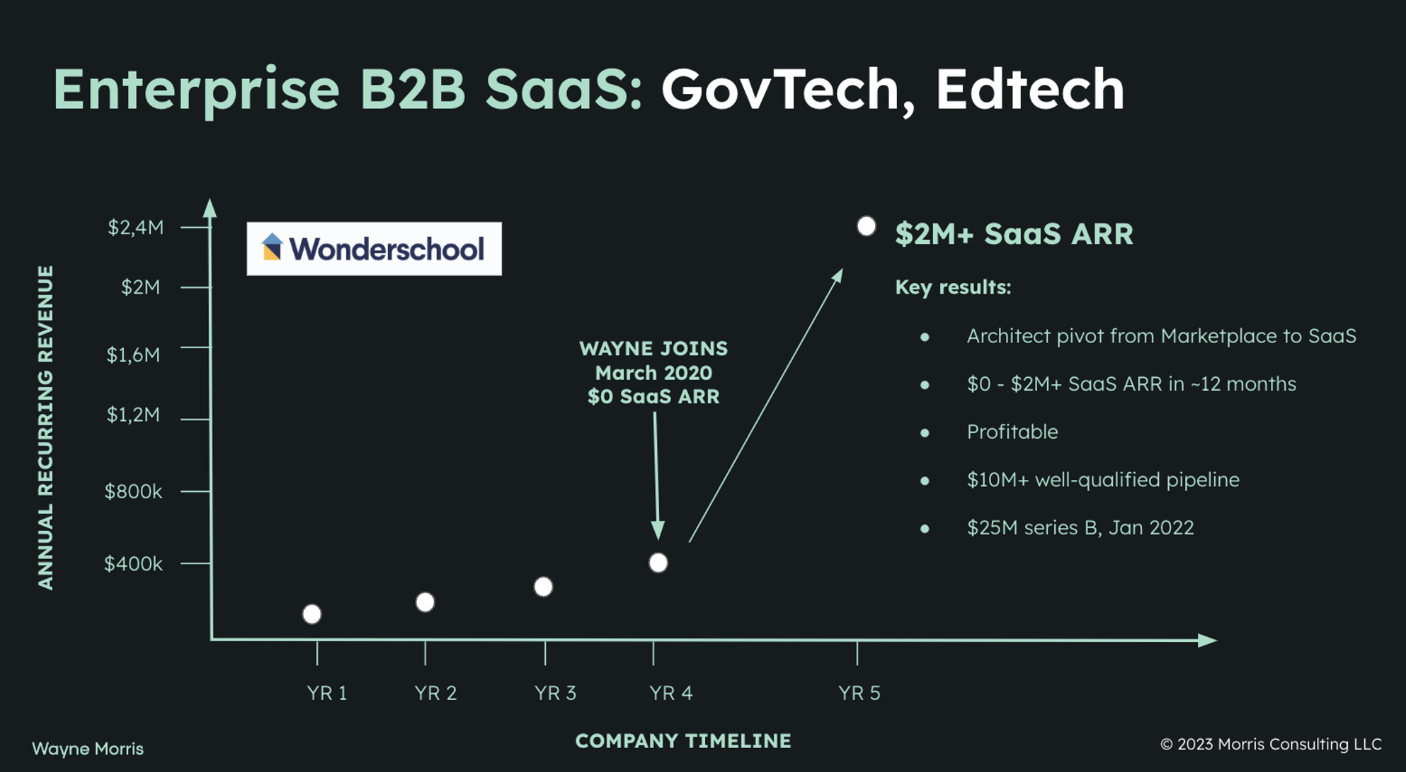

This process is one of the key common themes across my back-to-back successes as a GTM executive in SaaS dating back to 2009, and a process I insist upon in each of my clients today.

In reality, founders should use the capital they raise once they have product market fit, to go backwards initially rather than forwards. Clearly, that pitch won’t fly with investors, however with the context shared in this article founders will have a much greater chance of justifying how they intend using the capital they are looking to raise.

Most importantly though, regardless of what investors think, you’ll actually be building a business that sustains and repeats its success.

I’ll leave you with this, when we did this at Wonderschool (’20-’21), we did it whilst cutting 70% of our cost base, and reached profitability and multi-million $ of net new NRR with a pipeline of >$10M in under 12 months… …and that was during the height of the global pandemic.

Fig 6: Actual growth numbers in one of my previous businesses that followed my framework.

So it is 100% real and possible to have outsized success in a short space of time, even with macroeconomic headwinds, but only if your execution is on point.

If you’re a founder and this resonates, I’d encourage you to consider if you qualify for our Scale Audit program by clicking here. If you do, let’s dive deeper on a 30-minute call.

You’ve got this 👊🏼

Wayne

#SaaS #Sales #startups #venturecapital #GTMdebt

PS: My continuum is a constant work in progress. For as long as the dynamics of the SaaS industry are evolving and I continue to gather data live from the field in my work, the continuum will remain a live piece work. Stay tuned for any updates with requisite explanations.

Whenever you're ready there are 2 ways I can help you:

1. Executive co-pilot: If you're a CEO/Founder of a B2B SaaS Startup and this content resonates and you want hands-on help in your B2B SaaS startup, consider working with me directly in your business:

Step 1: Book a Strategy Call - A high-level assessment of your GTM debt.

Step 2: Scale Audit - A deep dive into the actions and priorities to get you to scale

Step 3: Executive co-pilot - Me and my team will guide you from your stage of growth to scale, de-risking your B2B SaaS startup.

Start HERE, by booking your strategy call.

2. Free reading: Subscribe to my channel for free insights on how to evolve from founder-led sales successfully and/or more up-market into the enterprise.

*Newsletter - Join over 1,000 founders, VCs, CEOs and CROs and receive insights from my 25+ year career in fast-growth enterprise B2B SaaS startups.

*Linkedin - Follow me on Linkedin for daily takes on fast-growth enterprise B2B SaaS startups

*Twitter - Follow me on Twitter for daily takes on fast-growth enterprise B2B SaaS startups